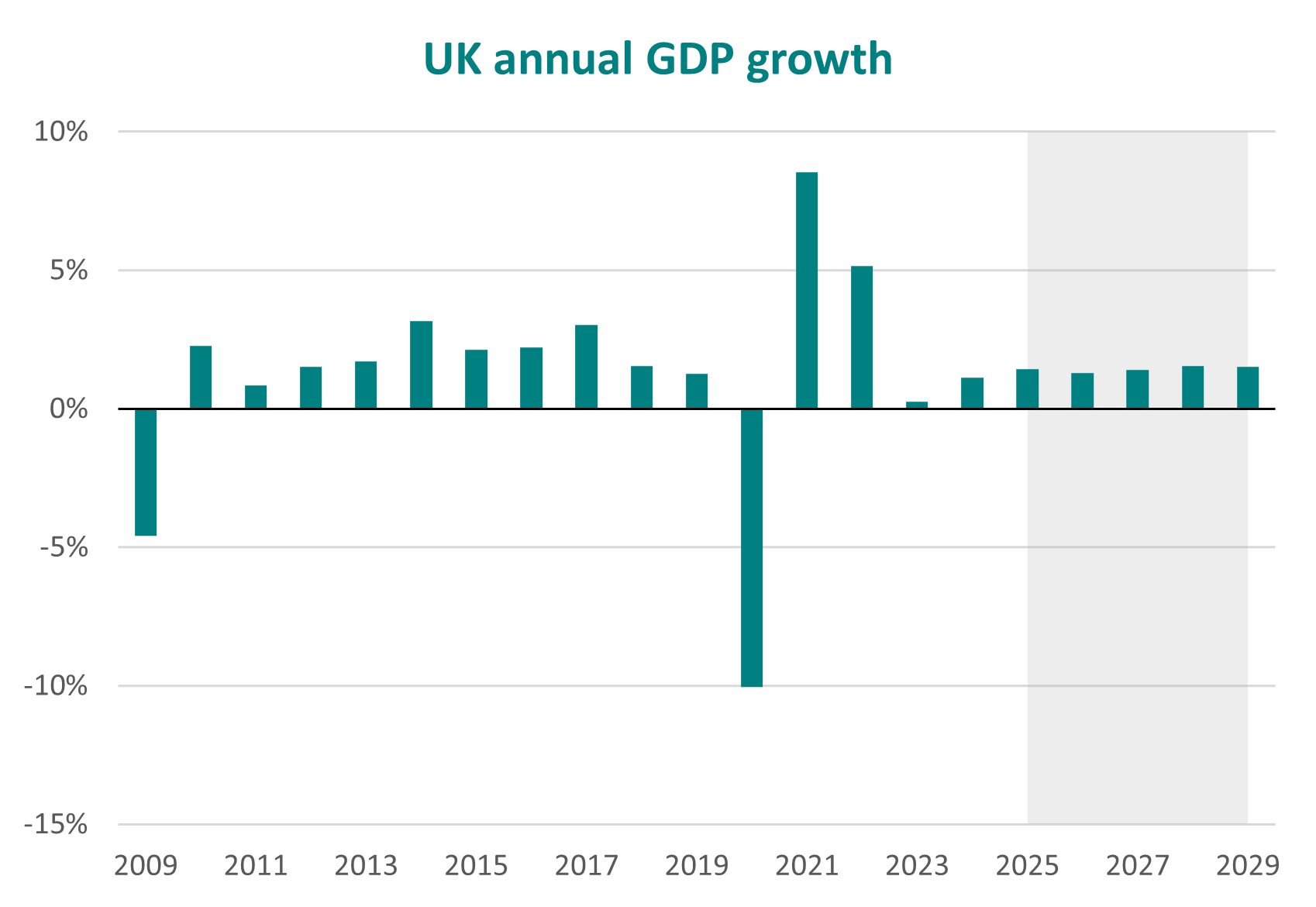

UK GDP growth lost momentum in the second half of this year, growing only 0.1% on the quarter in Q3 2025. The slowdown was primarily driven by a contraction in the production sector and weak household demand, amplified by easing labour market conditions, and fiscal uncertainty weighing on confidence. Growth is expected to remain modest over the medium term, with a slight slowdown expected in 2026.

UK CPI inflation stood at 3.6% in October and is set to decline throughout 2026 before returning to the 2% target at the start of 2027. Continued signs of labour market easing, alongside growth concerns, increase the likelihood that the Bank of England will cut the Bank Rate to 3.75% in December 2025.

The Eurozone showed subdued growth in Q3 2025. Despite a modest acceleration in the latest monthly inflation figures, headline inflation remains close to target and is forecast to fall over the coming year. The US outlook remains unclear due to a lack of available data increasing uncertainty.

London, the South East, and the North East are set to drive growth in 2026, with the devolved nations lagging behind. Alongside a weaker growth outlook for the UK as a whole next year, annual growth is expected to slow across all but one region in 2026.

The Chancellor’s package of fiscal changes announced in the Autumn Budget have enabled her to more than double fiscal headroom. However, the scale of the increases and the limited emphasis on growth-oriented measures could put her simultaneous goal of supporting long-term economic growth at risk.

• UK growth prospects

• The labour market

• Inflation and interest rates

• Global growth prospects

• Regional prospects

• Topical economic issues