Yesterday’s announcement by Rishi Sunak, Chancellor of the Exchequer, signals that the Government is waking up to the extreme challenges faced by many UK households as prices continue to soar. All in all, the May 2022 Cost of Living Support package represents a generous intervention, which will particularly help the most vulnerable households in keeping pace with the cost of living. However, more medium-term risks are posed by uncertainties around the schedule for the Government’s new windfall tax on oil and gas companies, as well as the fact that upside risks to inflation remain and – if households are granted further cash regardless of means – may well intensify.

The measures announced by the Chancellor, and the cost to the Treasury, can be summarised as follows:

- Cost of Living Payment (total spend over £5.4bn): £650 payment to more than 8 million low-income households in receipt of means-tested benefits, via two lump sums (July and in the autumn).

- Pensioner Cost of Living Payment (£2.5bn): £300 to pensioner households receiving the Winter Fuel Payment, paid in November/December.

- Disability Cost of Living Payment (£0.9bn): £150 payment, by September, to those in receipt of disability benefits.

- Energy Bills Support Scheme (£6bn): doubling of the £200 October energy bill discount to all households, which will now be non-repayable.

- Energy Profits Levy (raising £5bn in first year): new tax on oil and gas company profits, increasing the headline rate from 40% to 65%, with a new 80% investment allowance. To be phased out when oil and gas prices normalise (latest 2025).

In his statement, the Chancellor stressed that fiscal support should be “timely, temporary, and targeted”. Our analysis evaluates his announcements against these three criteria.

Targeted

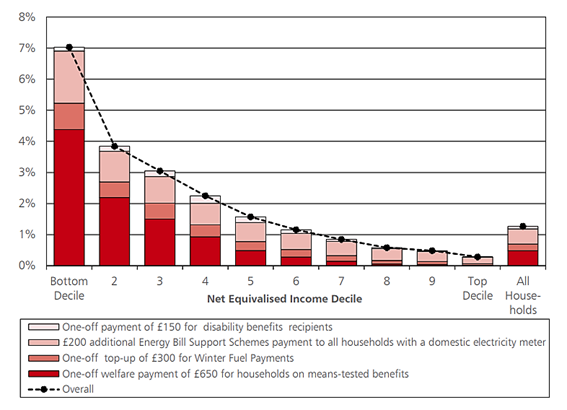

The Government has allocated £9bn to help support over eight million households on means-tested benefits. Considering all of the new measures announced, for English households, total support for the bottom income decile will stand at above 7% of total income, and just under 4% for the second decile, compared to just over 1% across the whole income distribution. All in all, we judge the new support measures to be well targeted towards those most in need, making them largely progressive.

Figure 1: Impact of measures announced in May 2022 on English households in 2022/23, as a percentage of income, by income decile

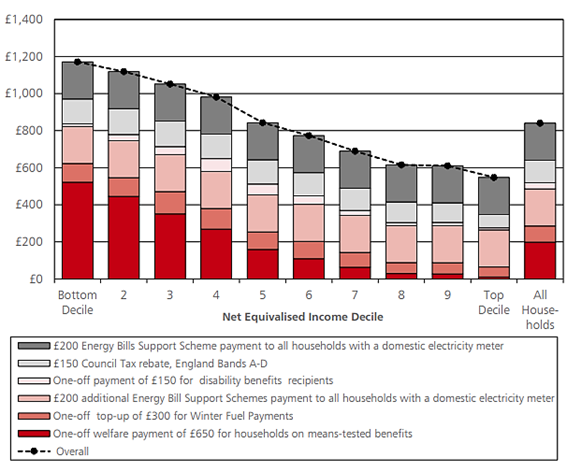

The Treasury’s latest intervention follows this week’s signal from Ofgem that October’s further energy price cap rise could take the average annual bill to £2,800, marking a year-on-year rise of 119%, or £1,500. Across the twelve months to October this year, a typical household is likely to have paid a total of £1,600 in energy bills. Under the support measures announced this spring (both in February and this month), bottom-income-decile households in England are estimated to receive just under £1,200 in help, more than £800 of which comes from the latest package. As such, the support announced will go a significant way in protecting the very poorest from the energy price shock. However, further targeted support will likely be needed if prices do not fall in spring 2023, meaning that the sizeable spending commitments made so far this year may prove to be a temporary plaster.

Figure 2: Impact of measures announced in February and May 2022 on English households in 2022/23, in cash terms (£ per year), by income decile

While the bulk of the new support is well targeted, this is clearly not the case for the Government’s announced update to the Energy Bills Support Scheme, under which all UK households will receive an automatic £400 credit on their energy bills in October. With better off households more able to absorb higher the cost of higher food and utility bills, much of the £6bn spending is likely to be unnecessarily burdensome on the public purse. It may also risk stoking a certain degree of demand-pull inflation in 2023, a development that will be closely followed by observers including the Bank of England. Having said that, the support will be welcomed by those on moderate incomes, whose lifestyles are likely facing a considerable blow from continued energy price rises.

Timely

In his statement, the Chancellor emphasised the need for timeliness in fiscal support measures. This is somewhat ironic, given that Cebr and other commentators have for months been clear on the need for more financial help, in the face of rapidly worsening cost-of-living pressures. Moreover, the main support scheme to help lower-income households, namely the Cost of Living Payment for those on means tested benefits, is the only payment scheduled to come into action in the next two months, with the first lump sum of the total £650 expected to be delivered in July.

The other support measures, including the £300 Pensioner Cost of Living Payment and the £150 Disability Cost of Living Payment, are expected to be delivered towards the tail-end of the year. These households suffer greater exposure to rising costs, and the fact that the payments are coming much later this year is troubling. Of course, even if these households manage to cope with higher bills until winter, when the Ofgem price cap is lifted and energy usage for the year will peak, there is no guarantee that the scheduled payments will arrive on time. The £150 Council Tax Rebate is a prime example, with many households still yet to receive their payments since the roll-out of the scheme in April. If this trend persists with the current support measures, many lower-income households could possibly face a scenario in which they don’t receive a majority of their entitled payments until early next year, placing a heavy burden on their finances and potentially pushing many into debt.

Temporary

Finally, the Chancellor stressed that appropriate fiscal intervention should be temporary in nature. While all payments to households represent one-offs and are pencilled in before the end of the year, a core source of uncertainty here relates to their financing. The Government’s U-turn on introducing a windfall tax on North Sea oil and gas companies – which it instead refers to as the ‘Energy Profit Levy’ – is largely welcome. This mechanism will contribute to a third of the total spend on the newly announced support measures. Yet, the Chancellor noted that the Levy will remain in place until oil and gas prices are seen to normalise, with a sunset clause included that will phase the tax out by the end of 2025 at the latest. At best, this stretches the meaning of temporary, leaving a rather open-ended schedule for the policy in light of the considerable uncertainty over future energy prices and a potential headache for affected companies.

In its simplest form, levying a tax on the supernormal profits of North Sea oil and gas companies would be expected to reduce investment at a critical time, relative to a world without such a tax. However, by introducing a new investment allowance rate of 80%, the Government has built incentives into the windfall tax package that will reward those who invest. Nonetheless, as the generous incentive element reduces the net tax take from the policy, we judge that the Government could have gone further, for example by applying a higher rate of tax. Furthermore, should energy prices remain elevated in the medium-term, companies subject to the tax could see a disproportionate fall in incentives to invest. A further trade-off stems from the additional complexity that this implies for the industry’s tax structure, which may reduce the efficiency of the system as a whole.

Conclusion

In all, the latest announcements provide far more comprehensive and progressive support than was seen in the March Spring Statement, even though many would claim that the unprecedented largesse is a bid to redirect attention from the recent scandals plaguing the ruling party. Significantly, the Chancellor’s U-turn on introducing a windfall tax signals a shift in intention toward relying on taxation to pursue a redistributive approach to the cost-of-living crisis. This helps to avoid adding additional money to the economy and putting upward pressure on prices, while still ensuring that the Chancellor’s mandate of managing public finances is met. The latter is especially pertinent, given that the vast amounts pledged this year follow two years of staggering pandemic stimulus spending.

A sizeable chunk of these measures is set to be paid out towards the end of the year, and our calculation suggests that the £400 Energy Bill Rebate alone is expected to cover the entirety of the average household’s electricity bill across October, November, and December, as well as over a third of January’s bill. With electricity making up a notable portion of consumer price index (CPI) calculations, Cebr believes that inflation readings for those months will fall, before shooting back up in 2023. Our previous forecasts pointed to CPI inflation in October 2022 reaching 10.4%, following an anticipated significant further rise in the Ofgem price cap. With the payment of the doubled Energy Bill Rebate, we now expect the headline October figure to be reduced by 0.5 percentage points to 9.9%. This assumes that the rebate will be directly factored into ONS inflation estimates.

The respite brought by the newly announced measures will not herald the end of the cost-of-living crisis. This will persist until headwinds facing the economy, including rising energy prices and supply-chain disruptions, subside. The sobering truth is that these factors are to a significant extent outside the control of UK businesses, policymakers and consumers. While a quick end to Russia’s war in Ukraine and lockdowns in China would be certainly welcomed, the optimal domestic response for now remains a reactive approach that aims to limit the damage to the economy and those worst affected. Yesterday’s announcements were a largely sensible step in that direction, though more still might need to be done in the future.

For more information please contact:

Karl Thompson, Economist, Email kthompson@cebr.com Phone 020 7324 2850

Pushpin Singh, Economist, Email psingh@cebr.com Phone 020 7324 2850

Cebr is an independent London-based economic consultancy specialising in economic impact assessment, macroeconomic forecasting and thought leadership. For more information on this report, or if you are interested in commissioning research with Cebr, please contact us using our enquiries page.