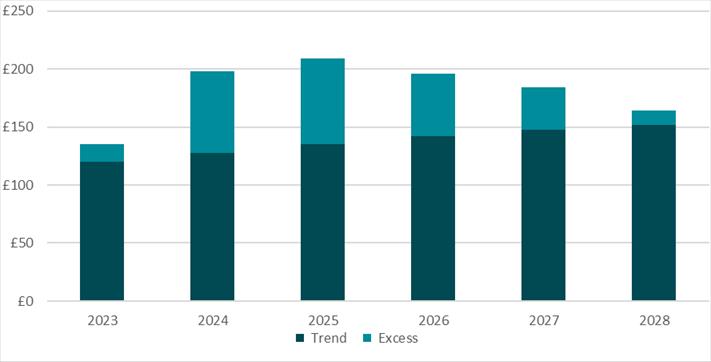

In recent years, UK consumers have been increasingly cautious, allocating a growing portion of their income to savings. Cebr estimates that between 2023 and 2025, the elevated saving ratio saw the accrual of approximately £160 billion in excess savings, which could be put to better use.

Looking ahead, Cebr expects the saving ratio to remain above its pre-pandemic level, averaging 9.1% over the next three years. This will be supported by continued cautiousness amidst economic uncertainty, but down on recent years, reflecting the expectation of falling interest rates. This would equate to an additional £104 billion of excess savings, the unleashing of which would help to boost the economy during a period of weak growth.

Figure 12 – Household savings, 2023-28, billions

Source: ONS, Cebr modelling

The savings ratio, defined as savings as a share of total household resources, reached a multi-year high of 12.0% in Q4 2024. Excluding periods affected by the pandemic, this marked the highest reading since 2010. More recent data showed a fall in the savings ratio to 10.6% in Q1, the first drop in almost two years. Whether this marks the start of a downward trend remains uncertain, but the ratio is still well above the 6.3% average recorded in the five years preceding the pandemic.

Higher interest rates, implemented to counter inflation, have naturally encouraged saving by providing increased returns. Additionally, the way households save reflects how they view the world and their future trajectory within it. In response to recent shocks to the economy, consumers are therefore displaying precautionary behaviour, building a buffer against future volatility, or indeed rebuilding funds drawn from during recent times of hardship.

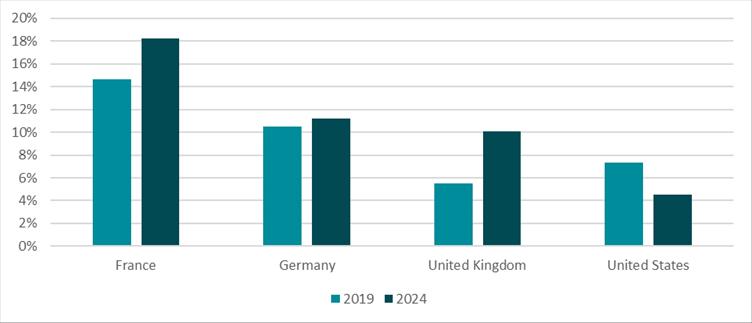

This greater precautionary behaviour is reflected in a range of data sources. The GfK Consumer Confidence Index found the desire to save among respondents was at its highest level since November 2007 in July. Similarly, the YouGov/Cebr Consumer Confidence Index shows forward-looking sentiment on household finances remains firmly negative. Meanwhile, data show that UK consumers, traditionally viewed as having a spend-first, save-later approach similar to that of Americans, are now saving at levels closer to their counterparts in Europe.[1]

Figure 2 – Household saving ratios by country

Source: ONS, BEA, INSEE, Bundesbank

Consumer spending is the lifeblood of the UK economy, accounting for 60% of economy-wide expenditure in 2024.[1] Consumption drives demand for goods and services, supporting labour demand, incomes, and tax revenues. Every unit of saving ultimately represents forgone demand-side activity.

Though negatively correlated with consumption, savings can help to support the supply side of the economy, by providing lenders with a source of liquid funds to direct towards investment. Despite the rapid growth in excess savings in recent years, the weak performance of business investment in the UK suggests that money held in accounts is not being effectively deployed. As described, the pool of excess savings made by UK consumers has grown in recent years and is forecast to total over £260 billion between 2023 and 2028.

The government is aware of this untapped resource, having recently considered reforms to Individual Savings Accounts aimed at more private investment amongst consumers. While these plans were ultimately shelved, they show Treasury recognition of the need to use consumer funds more productively.

Elsewhere on the policy front, the upcoming Autumn Budget will be important in shaping the outlook for household saving behaviour. Potential changes to pensions, ISA allowances, and inheritance rules could all influence how and where people choose to save.

The UK finds itself at a crossroads. High household savings may provide a buffer against future shocks, yet faced with a tepid growth outlook, unlocking a greater share of the cash held in UK savings accounts is necessary to regain stronger economic momentum. For policymakers, the challenge lies in encouraging more productive use of these savings, whether through investment, consumption or entrepreneurship, without undermining the sense of security that savers now seek. Achieving this will be crucial if the UK is to unlock this accumulated capital and reignite economic growth.

Cebr’s next Forecasting Eye will be released on 17th October.

[1] https://commonslibrary.parliament.uk/research-briefings/sn02787/

[1] https://am.jpmorgan.com/gb/en/asset-management/adv/insights/market-insights/market-updates/the-uks-savings-opportunity/