A perfect storm for British pubs

The Great British Pub has long served as a bellwether for the economy, and in recent years that bell has been ringing alarmingly loud. Just as operators began to recover from the unprecedented shock of the pandemic a brutal combination of economic headwinds struck the pub sector. High inflation squeezed household budgets, energy prices surged and labour shortages plagued hospitality businesses, while shifting consumer preferences and attitudes have continued to dampen demand.

These pressures have been compounded by a relentless policy environment. Substantial national minimum wage increases, hiked employer National Insurance contributions, complex licensing regimes and the third-highest beer duty in Europe have piled the pain on operators and their bottom lines. Unsurprisingly, many pubs are struggling just to keep their taps running. The British Beer and Pub Association (BBPA) estimate 378 British pubs shut their doors for good in 2025 alone.

Business rates at the brink

Against this backdrop, business rates have loomed as one of the most immediate and damaging threats.[1] Prior to the 2025 Budget, pubs faced the removal of retail, hospitality and leisure (RHL) relief that provided vital support to the sector following COVID, combined with upcoming property revaluations that could significantly increase pubs’ business rates bills. With the sector already under severe strain, these combining factors could deliver substantial tax hikes that would push many pubs to the brink, if not addressed at the Budget. It was in this context that Cebr were commissioned in summer 2025 by the BBPA to contribute robust economic evidence to the policy debate.

Our research objective was to effectively demonstrate and quantify this problem. To do this, we undertook detailed modelling that assessed the impacts of potential business rates changes on individual pub finances, aggregating these effects across the pub sector and up to the broader national economy. We estimated business rate bills, pub closures and economic impacts under three scenarios of government support: complete withdrawal of support, a partial support package and more generous, maximal support.

Withdrawal of support could decimate our pubs

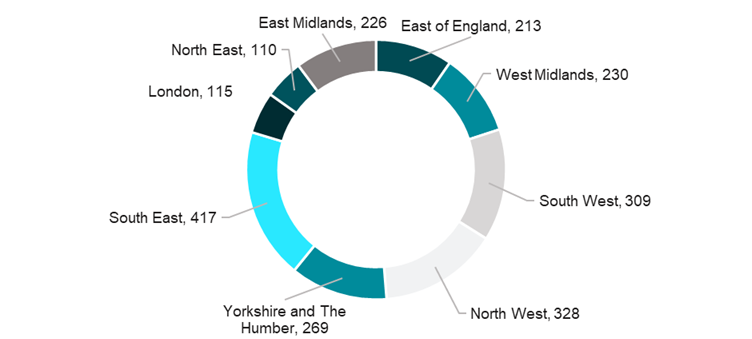

Cebr estimated pubs would face a 55.8% increase in business rate bills in the next tax year under full withdrawal of support and reliefs. This represents a £260.4m increase in total business rates receipts across the sector versus 2025/26, with total business rates liabilities reaching £727.3m in 2026/27. The average pub’s annual business rates bill would therefore grow from £12,795 to £19,932 under this scenario. Given these drastic bill increases, Cebr modelling indicated 2,217 English pubs were at risk of closure in 2026/27 if business rates support was withdrawn – equivalent to 1 in 16 pubs throughout the country. Figure 1 visualises the distribution of pub closures across regions.

Figure 1: Number of English pubs at risk of closure under withdrawal of BR support by region, 2026/27

The pub multiplier effect

Government support would mitigate both business rates bill increases and a sizeable share of damage to the pub sector. Cebr modelled this support through lowering business rate multipliers,[2] as our maximal scenario captured a 20p reduction to pubs’ multipliers across the board. This reduction produced an average pub business rates bill of £12,629 per year – down 36.6% from the potential bill under the withdrawal of support. Across the pub sector this generates total business rates receipts of £460.8m in 2026/27, just 1.3% lower than tax receipts under the current, 2025/26 baseline.

Business rates support also significantly improves pub viability, driving impacts throughout the broader economy. Of the potential 2,217 pub closures in the complete withdrawal of business rates support, 889 pubs would no longer be at risk of closure under the maximal support scenario. Even the partial, more targeted support package delivered meaningful impacts,[3] elevating 690 pubs out of closure risk. Reducing pub closures translates into substantial economic benefits, as the maximal support scenario generates a direct Gross Value Added benefit of £98.4m and saves 5,468 jobs. Figure 2 illustrates these positive economic impacts alongside the partial support package.

Figure 2: Total GVA and employment benefits of mitigated pub closures under business rates support scenarios, 2026/27 (£m, 2026 prices)

Analysis-backed campaigning

Cebr’s analysis provided a powerful evidence base that underpinned the BBPA’s campaigning and wider policy engagement. Findings were presented to Treasury policymakers, industry leaders across the sector and reported on by the Telegraph. At the subsequent 2025 Budget, the government announced continued business rates support for pubs through RHL-specific multipliers and transitional relief. While this was a welcome step, it stopped well short of resolving the underlying problem. Limited RHL multiplier reductions did not do enough to offset significant increases in property valuations. This led to larger business rate bills for the vast majority of pubs, for which transitional relief merely delays this pain.

Sustained post-budget campaigning – backed by economic analysis – has since secured a further support package for pubs. Government announced this week an additional 15% discount on pubs’ business rates in 2026/27, on top of the transitional relief provided at 2025 Budget, followed by a real-terms freeze of rates bills for a further two years. This is a significant win for the pub sector, reflecting both the strength of the economic case put forward and the success of BBPA and other industry stakeholders in communicating it.

[1] Business rates are a local tax paid by businesses in the UK on their properties used for business operations (shops, pubs, offices, warehouses etc.), that are levied based upon the value of the property.

[2] Business rate multipliers operate functionally as the tax rate for the calculation of business rates. They range from approximately 0.4-0.6, and are multiplied by a property’s assessed value to derive business rate tax bills.

[3] Partial support scenario reflects a 15p multiplier reduction for smaller pubs and a 10p reduction for larger pubs.