Last night’s announcement by the Prime Minister that England would move into Plan B over the next week – mandating mask wearing in indoor settings, guidance to work from home (WFH), and vaccine passports for crowded and large venues – doesn’t come without economic costs.

Most significantly among the new restrictions, a shift to homeworking next week will induce a step change in commuter and thus city-centre consumer behaviour. Cebr estimates that the WFH order will result in a £0.5 billion spending shortfall in just five cities alone over the next month. On the other hand, we judge that restrictions relating to mask-wearing and Covid certification measures are unlikely to imply significant economic costs on balance, as consumers and businesses have increasingly adapted to such measures throughout the pandemic. A short-term cost may however be felt by businesses as they implement such measures over the coming days.

Meanwhile, independent of Plan B, increased nervousness over the new variant and stricter travel restrictions are expected to cause a loss of £0.9 billion in UK hospitality revenues this month, and £0.4 billion in inbound travel spending.

Work from home order

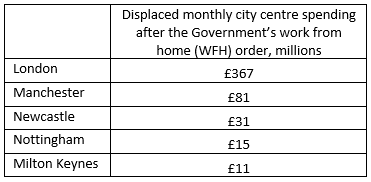

We estimate that the Government’s work from home guidance will cause a £505 million reduction in city centre spending in five of England’s largest cities – London, Manchester, Newcastle, Nottingham and Leeds. [1,2] This captures the amount that workers would have otherwise spent in shops, pubs and eateries near employment hubs in the five cities, which instead will be lost or displaced in the switch to home working over the winter months. Estimates suggest that the coronavirus pandemic has resulted in a total of £13.1 billion of displaced city centre spending so far – in these five cities – with the renewed foregone spending implying a further blow for businesses that rely on commuter pounds.

In November 2021, data from Google Mobility Trends indicated that the number of people going to places of work on weekdays in the UK remained 28% lower than before the pandemic. Cebr expects that, with WFH now being recommended again, relative office attendance levels will return to those seen in June, when numbers stood 32% lower than pre-pandemic levels across the UK, and 42% lower in London. Using Google Mobility data for each city along with statistics on average spending near offices prior to the pandemic [3] and the number of employees in each city, estimates of lost city-centre spending are generated. Among the cities considered, this shows the largest blow to city-centre spending in London, at £0.4 billion, followed by £0.1 billion in Manchester.

Hit to festive hospitality spend

The move to Plan B comes alongside increasing nervousness around the Omicron variant, altering consumer behaviour even in the absence of added restrictions. Notably, the past week has seen rising discussion around the cancellation of Christmas parties, causing concern for one of the industries hit hardest by the pandemic. A study by UK Hospitality published last week revealed that, relative to expectations from 2019, bookings for the festive period were down 12.4% on average. [4] Applying this reduction in bookings to forecasted revenue in the “Food and beverage servicing services” industry from 6th December, Cebr estimates that the Omicron variant will reduce revenue in the hospitality industry by £0.9 billion this month overall. This equates to roughly 9.5% of otherwise expected industry revenue for the month.

Dent to travel spending

In addition to city-centre and hospitality spending, recently tightened travel rules are likely to see a hit to inbound travel spending in December. Measures introduced this month mean that those travelling to the UK must show proof of a negative test prior to departure, as well as self-isolate on arrival before receiving the results of an additional test. Meanwhile, eleven countries have been added to the UK travel red list.

Increasing travel restrictions and the growth of the Omicron variant are likely to reverse a recent trend seeing air passenger numbers returning toward pre-pandemic levels. According to the most recent Government Air Passenger Information statistics, UK arrivals in October 2021 were 54% below those seen in the same month in 2019, a significant recovery compared to the equivalent figure of 95% in May 2021. [5] Cebr expects that inbound travel at the end of November was just 43% below levels seen two years prior.

Assuming that recent developments in the pandemic have caused inbound travel to reduce to levels seen in September, at 65% below equivalent 2019 levels, Cebr expects a £0.4 billion dent to UK spending by foreign visitors this month alone.

Although the Omicron variant was first reported by South Africa on 24th November, a mere two weeks ago, its effects on the UK economy are already being felt. Much of this will come from increased consumer nervousness, with the hospitality industry likely to face a tricky few months. If new Plan B restrictions can bring the spread of the variant under control and restore confidence, a softening of this blow may be achieved. In any case, however, a return to homeworking and stricter travel rules are likely to provide a longer-lasting economic dent.

[1] Please note that these workers will still be spending on items such as lunch food, snacks, drinks and stationery near their homes. Therefore, this study does not necessarily suggest that the UK economy has shrunk by the figures calculated, but a significant amount of spending has been displaced away from employment hubs.

[2] The cities were selected on the basis of size, regional variation within England and Google mobility data availability

[3] a. https://www.google.com/covid19/mobility/ b. https://cebr.com/reports/london-still-looks-like-a-ghost-town-costing-its-hospitality-sector-2-3-billion-between-march-and-june-in-foregone-lunches-and-after-work-drinks/

For more information please contact:

Josie Dent, jdent@cebr.com 020 7324 2864 or Karl Thompson, kthompson@cebr.com