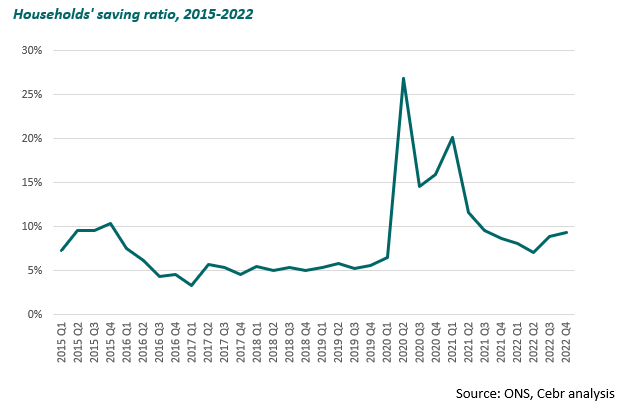

With inflation still near record-highs and real wages falling, it would be easy to see how UK consumers are drawing down their savings to pay for their bills. Cebr previously reported on the forced savings accumulated during the pandemic[1] and it would seem sensible for the savings rate to fall precipitously now that many households are likely forced to dip into their cash buffer. However, the latest data by the Office for National Statistics (ONS) paint a different picture. In fact, the household savings ratio increased to 9.3% in Q4 2022, according to the latest data from the Office for National Statistics (ONS). This followed a relatively steady fall in the rate from 20.1% in Q1 2021 to 7.0% in Q2 2022. However, instead of falling back to around 5% – the average in the four years prior to the pandemic – the ratio climbed back up in the second half of last year to reach its highest level since Q4 2015, apart from the pandemic period.

The fact that households are managing to save more might come as a surprise, given the widespread increases in costs for food, utilities, housing and other categories, which is leaving most with less left over each month after their essential expenditure. Indeed, Cebr’s latest Income Tracker report[2] shows that household discretionary income (income less taxes and essential spending) was down by £28.77 a week year-on-year in February (a 12.2% annual decrease). With wage increases falling short of inflation and the prices of food and energy rapidly rising, spending power has dropped for the vast majority of households. So, why are we seeing savings rise on average?

The first reason for the increase in savings is that interest rates are higher, meaning it pays to save. Savings have become a lot more appealing now that the Bank of England has raised its main policy rate to 4.25%, up from 0.1% in December 2021, causing commercial banks to also increase the savings rates offered on their accounts, although with a considerable time lag. Secondly, the UK economy is on weak footing, with the latest ONS data showing no GDP growth in February compared to January, and Cebr forecasting a 0.2% contraction in GDP for 2023 as a whole. This has led to a rise in precautionary saving as people feel more uncertain about the future.

Many will not be able to save more, despite these incentives to do so. Cebr’s analysis shows that in February[3] the average weekly discretionary household income for the first two income quintiles (i.e. the bottom 40% of earners) was negative, at -£72 for the lowest income quintile and -£4 for the second quintile. These households are likely to be using up any existing savings or turn to borrowing to meet their monthly expenditures. Therefore, it will be the top earners contributing to the rising savings ratio. While the average discretionary income has fallen over the past year for all five income quintiles, it still stands at £209 a week for the fourth quintile and £742 a week for the highest income quintile. These households can either spend this money on non-essentials such as holidays or theatre trips or can choose to save it. The rising savings ratio suggests that more are choosing to put any spare cash aside.

With the UK economy seeing little growth, it might be wise for individuals to save at present. Indeed, a sustained rise in the savings ratio may also be healthy for the economy long-term to fund investment. Moreover, policy makers at the Bank of England will be pleased to see savings rise as this implies a reduction in aggregate demand in the economy and should help to ease inflation. Yet, less spending and weaker demand in the economy also raises the likelihood of a recession this year.

Looking ahead, the two main forces driving up savings may ease through the year. Cebr is only forecasting one more rate rise from the Bank of England, to 4.5%, and the Bank may even cut rates at the end of the year if inflation has shown a sustained fall. Furthermore, Cebr is expecting a gradual easing of inflation and improvement of GDP growth towards the end of 2023 and into 2024, meaning that any precautionary savings may be reduced. Evidence for a fall in the savings ratio this year also comes from that fact that output in consumer-facing services has risen in the latest GDP data for January and February, which may be due to households’ ability to reduce their saving compared to the second half of last year.

Therefore, while this rise in savings highlights that many households can take advantage of the elevated interest rate environment at present, it is the higher earners that can afford to do so. Thinking longer term, it is also important that the lower 40% of earners should be able to save, particularly to fund their retirement, and also for the sustainability of economic growth. With the Money and Pensions Service[4] estimating that nine million people across the UK have no savings and another five million have less than £100, ensuring that it is possible for more people to build a financial buffer will mean they are less dependent on debt or the government in times of hardship.

[1] Centre for Economics and Business Research (Cebr)

[3] Ibid.

[4] Money & Pensions Service (MaPS)

For more information contact:

Josie Anderson, Managing Economist – Email: janderson@cebr.com – Phone: 020 7324 2864

Cebr is an independent London-based economic consultancy specialising in economic impact assessment, macroeconomic forecasting and thought leadership. For more information on this report, or if you are interested in commissioning research with Cebr, please contact us using our enquiries page.