Data released by the Office for National Statistics (ONS) this week provide rich insight into the nation’s recent experience with financial vulnerability. [1] The data, covering September 2022 to January 2023, reveal that respondents’ housing status is one of the strongest predictors of individuals’ likelihood of experiencing some form of financial vulnerability, even when controlling for a number of different correlating factors. With mortgage payments and rents firmly on an upward trend, a stark gap between outright owners and other households is set to widen further still.

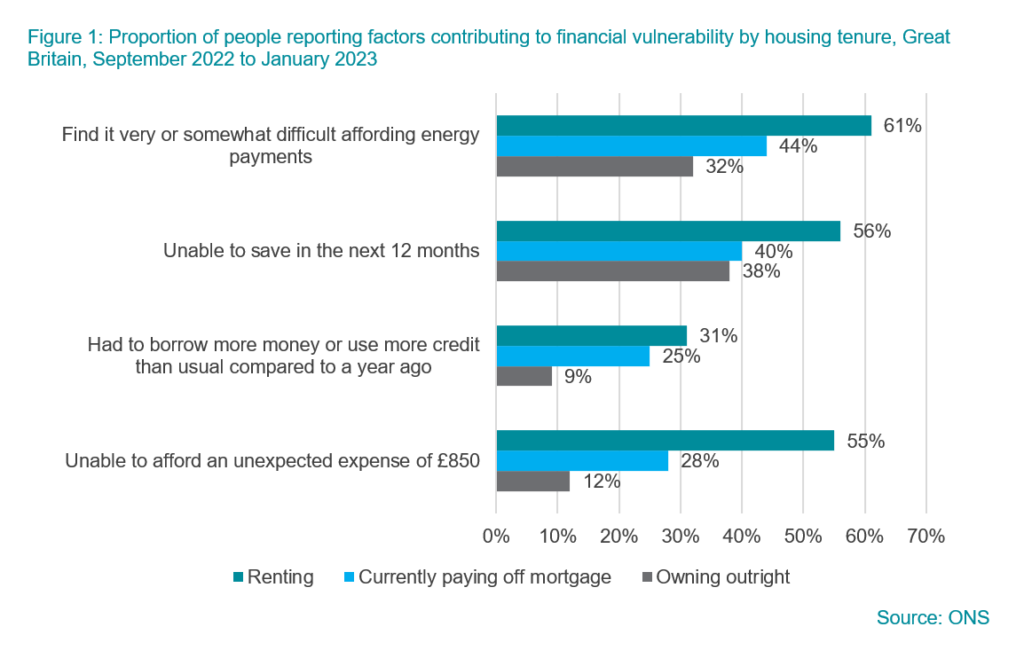

The ONS data show that, relative to those who own their home outright, homeowners with a mortgage were 2.3 times more likely to experience financial vulnerability over the four-month period, while renters were a staggering 4.4 times more likely. The factors considered in this analysis included the ability to afford unexpected expenses, having to borrow more money than usual, as well as the ability to save and afford energy bills. On all of these categories, the outright homeowner group saw the most favourable results, pointing to housing tenure as an important determinant in the current affordability debate.

As of the 2021-22 financial year, 64.3% of households in England were homeowners. [2] This is down from the peak of 70.9% seen in 2003, a development driven by a falling number of people buying their home with a mortgage. It has been mediated, however, by a steady upward trend in the number of people owning their home outright. This group has doubled in absolute size to 8.4 million households over 40 years, today making up the majority of all homeowners and over a third of all households.

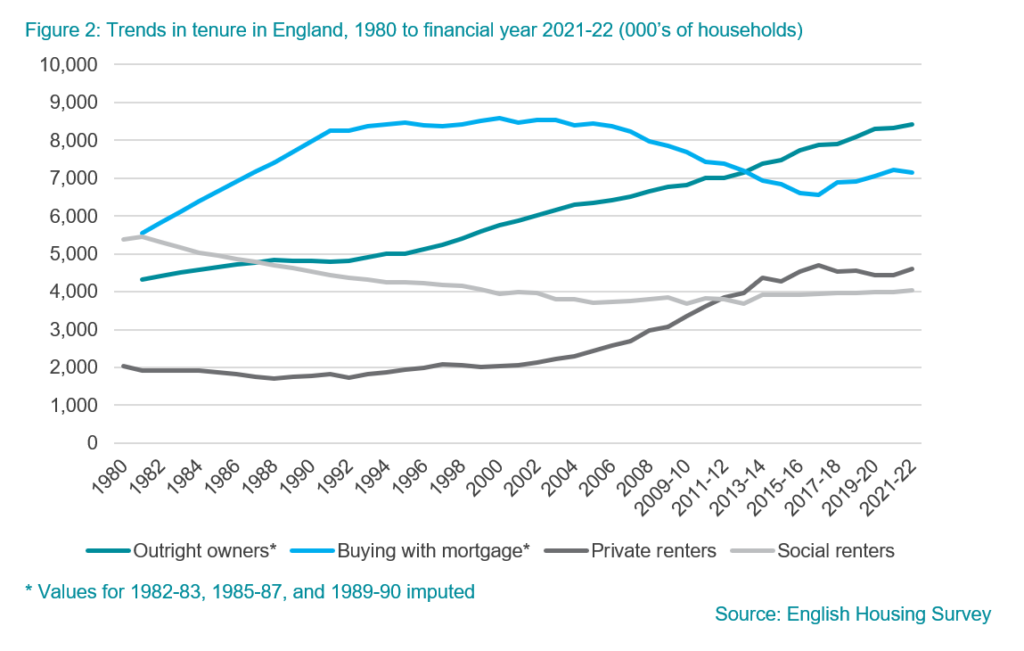

What do we know about outright owners? In England, nearly three quarters (74.5%) were aged over 65 in 2021-22, a share up from 70.5% ten years earlier. An even stronger increase has been seen in the retiree share of outright ownership, up from 69.4% to 77.1%. To a certain extent, these developments reflect the natural results of a longer-living and ageing population in a country that assigns strong value to homeownership. But they also point to generational inequalities in access to the housing ladder over time. The resultant wealth inequalities now appear to be rearing their head in terms of financial vulnerability during the cost-of-living crisis.

As the currently most financially vulnerable group by housing status, renters made up over a third (35.7%) of English households in 2021-22. This group is not only more likely to struggle with energy payments, setting money aside, and being able to afford unexpected expenses, they are also affected by rising rents themselves, increasing their financial vulnerability even further. The average UK rent agreed for new contracts rose by 10.2% in the year to January, with particularly fast growth in the capital, at 13.0%. [3] With an increasing number of buy-to-let landlords facing higher mortgage rates and regulations including a briskly approaching EPC requirement on newly rented properties from 2025 [4], many may soon decide to turn away from the private rental sector. This, alongside restricted housing supply overall, is set to keep rents high despite the recession that is expected to unfold this year.

However, renters are by no means the only group affected by the current crisis. More than two million fixed-rate mortgages are expected to expire between Q1 2023 and Q3 2024, roughly half of which we expect to see at least a threefold increase in their mortgage rate. [4] And though mortgage rates are currently falling back from the highs seen in the wake of last year’s mini-budget, repayments will rise for those whose fixes are ending. Rates are also unlikely to fall far below the Bank Rate, which Cebr expects to rise to a peak of 4.5% and remain above 4.0% until the latter half of next year.

Worsening mortgage affordability among this group, as well as prospective first-time buyers, is what drives our forecast that house prices will be down by 10.6% in annual terms by Q4 of this year.

It is worth noting that the past decade has seen a general reduction in homeowners’ exposure to mortgage rate cycles. The share of English households who are homeowners and have an outstanding mortgage fell from a third (33.5%) ten years ago to less than three in ten (29.6%) in 2021-22. Moreover, a sharp increase in the number of mortgagers agreeing fixed rate mortgages, and for longer terms, will shield some borrowers from the recent three-to-fivefold increase in rates. This is notably the case for five-year fixed rates, which came to take up a majority of outstanding mortgages from the second half of 2022. [5] Although this cushions the otherwise stronger anticipated falls over the coming quarters, house prices do have one direction of travel.

As energy price inflation is expected to drop away this year, rising mortgage payments and rents are set to become a dominant component of the cost-of-living debate. In light of this, the outright owner group are likely to find themselves largely shielded in the upcoming affordability crisis, in stark contrast to renters and mortgage holders – a development that is set to exacerbate existing wealth divides.

[2] https://www.gov.uk/government/statistics/english-housing-survey-2021-to-2022-headline-report

[3] https://homelet.co.uk/homelet-rental-index

[5] Newly rented properties will be required to have an energy performance certificate (EPC) rating of C or above from 2025, subject to some exemptions, compared to current rules that require only a rating of E or above.

For more information contact:

Karl Thompson, Economist – kthompson@cebr.com or forecasting@cebr.com – 020 7324 2866

Cebr is an independent London-based economic consultancy specialising in economic impact assessment, macroeconomic forecasting and thought leadership. For more information on this report, or if you are interested in commissioning research with Cebr, please contact us using our enquiries page.