As the Government this week unveiled the second round of its Levelling Up funding, amounting to £2.1 billion, renewed focus has been placed on the disparities between the economic prospects of the UK’s regions and nations. This is a pressing issue for the UK economy, and one that has taken a backseat in recent months. We highlighted this in our Forecasting Eye from last November, which found that the output per capita gap between richest and poorest regions is set to widen notably over the coming five years. [1] Our latest analysis suggests that, in the nearer term, the forces of earnings growth and inflation are themselves leading to a widening of existing regional disparities. This comes as those in the capital are currently expected to be enjoying the slowest fall in real earnings, as wage growth is thought to be more rapid and cost pressures less steep than in many other parts of the UK.

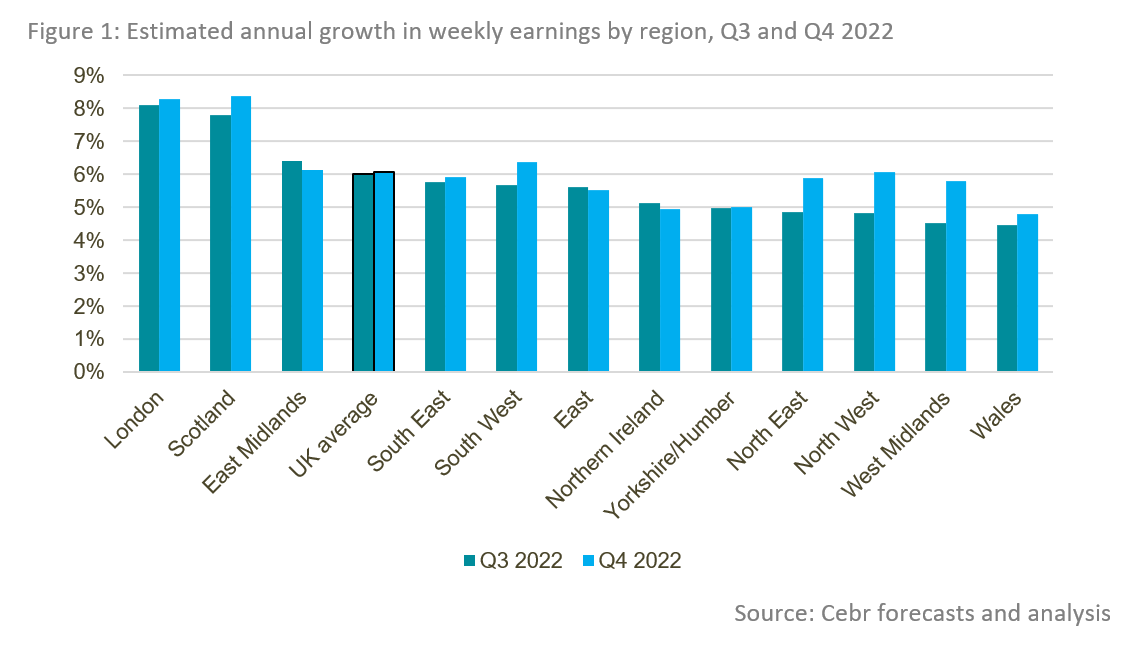

While official regional earnings data from the Office for National Statistics (ONS) are available only with a lag, our in-house modelling provides estimates up to the most recent full quarter (Q4 2022). As shown in Figure 1, annual growth in total weekly earnings is thought to have averaged 6.1% across Q4 last year, up slightly from 6.0% in Q3. Between the 12 UK nations and regions, earnings growth is expected to have picked up in all but three (the East Midlands, East of England, and Northern Ireland).

Notably, annual earnings growth in London and Scotland is expected to have accelerated above 8.0% in the three months to December 2022. Unlike the highs in earnings growth seen in the second half of 2021, which were partly driven by base effects in light of a slump in earnings in the early pandemic period, the latest figures represent wage growth driven by a tight labour market and higher inflation expectations. London has ranked at the top of this list for three of the past five quarters, widening the already sizeable gap between earnings in the capital and across the country as a whole.

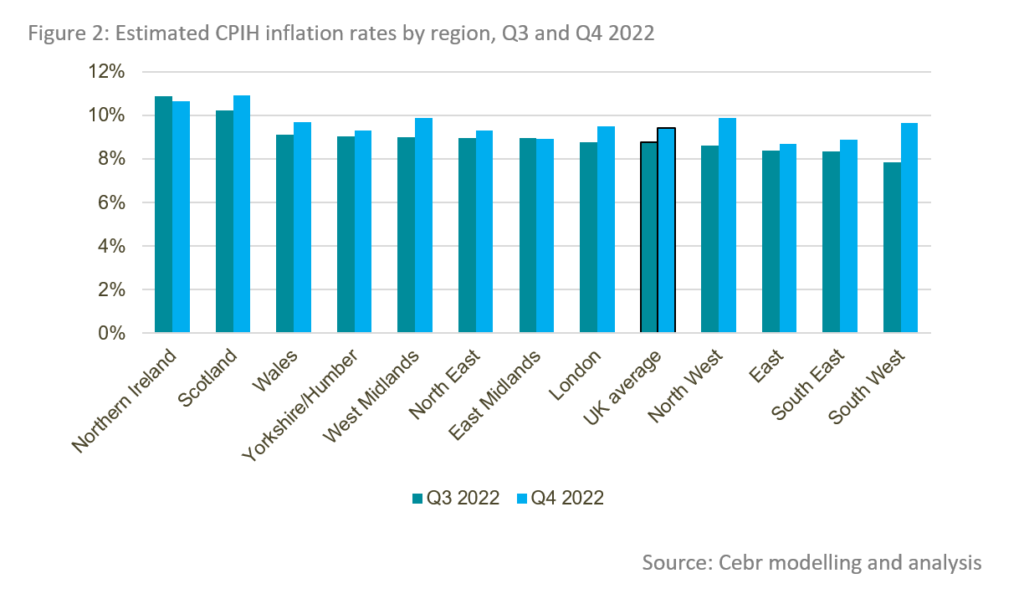

Wage growth is of course only part of the equation when it comes to considering changes in living standards. [2] While the ONS does not publish inflation rates by geography, our modelling uses regional disparities in spending patterns to approximate equivalent rates for inflation on the official Consumer Prices Index including owner occupiers’ housing costs (CPIH).

As seen in Figure 2, the highest regional inflation rates are currently estimated to be felt in the UK nations outside of England, with Northern Ireland and Scotland expected to be the only nations with double-digit inflation on our estimated CPIH measure across Q3 and Q4. Moreover, the relatively lower-income English regions of Yorkshire and the Humber and the North East rank among the highest in terms of estimated inflation rates. Looking at the capital, inflation is expected to be close to the national average, which is on the lower end of the regional spectrum.

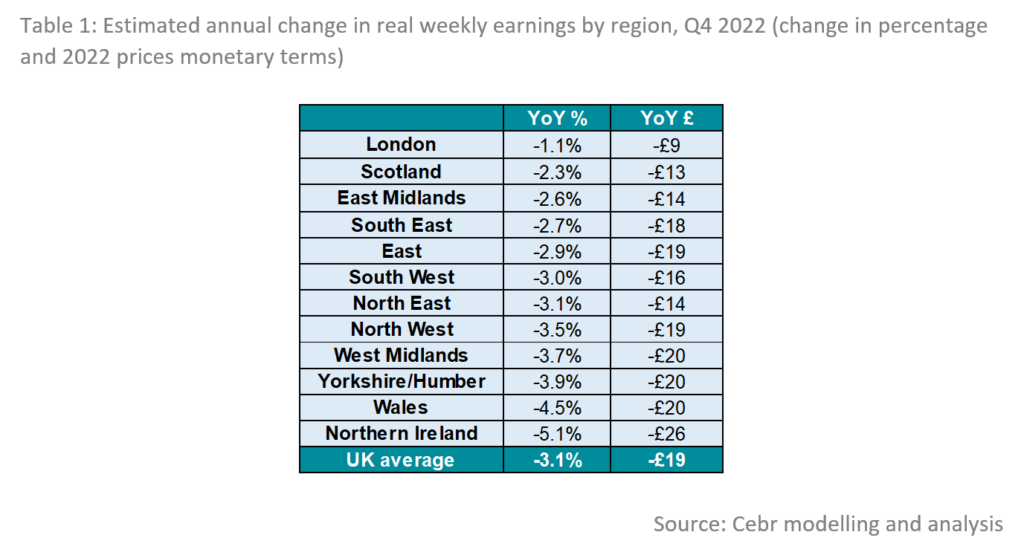

These elements can be combined to study developments in regional inflation-adjusted earnings growth, which is a key determinant of living standards. The results, presented in Table 1, show that the capital is estimated to have witnessed the least severe annual fall in real earnings in Q4 last year, with earnings adjusted for inflation down by just 1.1% on the year, compared to the national average of -3.1%. The table reveals that Scotland and the East Midlands saw the next smallest falls in living standards in Q4. At the other end of the spectrum, however, real earnings are expected to have fallen the sharpest in Northern Ireland (-5.1%), Wales (-4.5%) and Yorkshire and the Humber (-3.9%).

Expressing these changes instead in monetary terms (in 2022 prices), Q4 real earnings in London are thought to have been down by £9 per week on an annual basis. This was the lowest among all regions and compared to a reduction by £19 across the UK as a whole. The next smallest reduction was seen in Scotland, where real annual earnings were down by £13. Meanwhile, the annual reduction was sharpest in Northern Ireland, where wage growth and inflation dynamics meant that average earnings were down by £26 per week in real terms.

Higher earnings growth and lower inflation rates in richer areas are therefore making for a worsening of existing regional disparities across the UK, and notably with respect to the gap between London and the rest of the UK. This is not something that the government will be able to fix quickly, no matter how the remaining Levelling Up funds are allocated. The longer-standing challenges consist in creating high value-added jobs across the regions and attracting talented people from both within the UK and abroad to take up those jobs. This seems to be a nut that government has yet to crack.

[1] https://cebr.com/reports/gdp-per-capita-gap-between-richest-and-poorest-regions-set-to-widen/

[2] Other types of incomes including pensions and benefits, as well as the impact of taxation, have not been considered for this analysis.

For more information contact:

Karl Thompson, Economist – kthompson@cebr.com – 020 7324 2866

Cebr is an independent London-based economic consultancy specialising in economic impact assessment, macroeconomic forecasting and thought leadership. For more information on this report, or if you are interested in commissioning research with Cebr, please contact us using our enquiries page.