Would you expect an economy with a high tax burden and one of the earliest retirement ages in the developed world to be amongst the top performers in the years since the pandemic? France is that economy, being relatively resilient amidst considerable global volatility, despite having the second highest tax-to-GDP ratio in the OECD and a younger average retirement age than the UK, Germany, or Spain.

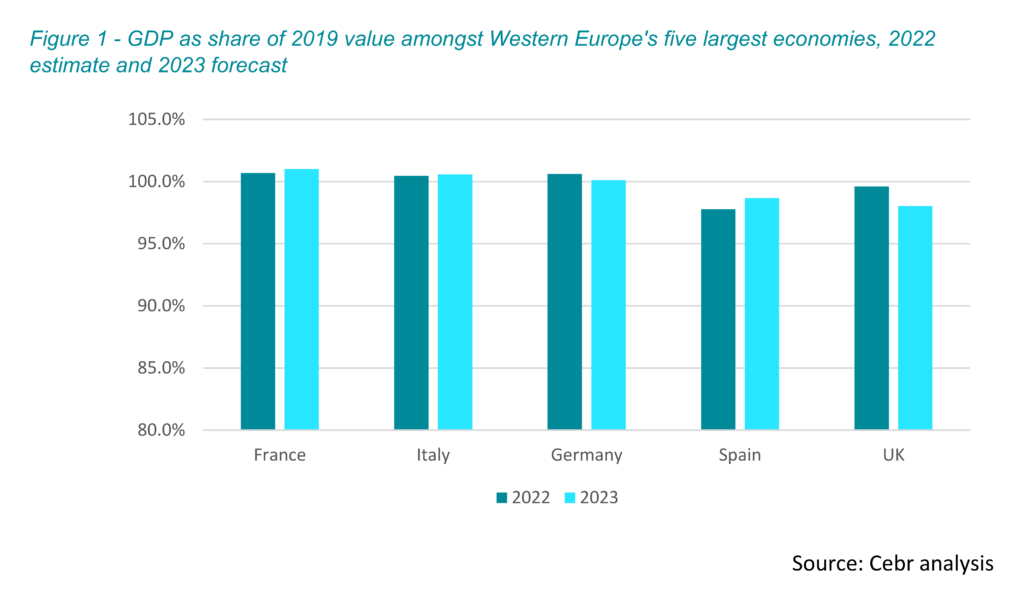

GDP in France is estimated to have been 0.7% higher than pre-pandemic levels across 2022, marking the best performance on this measure amongst Western Europe’s five largest economies. [1] For comparison, the UK economy was an estimated 0.4% smaller than its pre-pandemic size across 2022, meaning the gap between France and the UK on this measure stood at 1.1 percentage points. With France expected to see additional growth this year, and the UK set to contract, this divergence will widen further by the end of the year, reaching an estimated 3.0 percentage points.

So, what is explaining France’s success? There are a number of factors that have emerged or strengthened in recent years. In the years since Brexit, France’s financial services sector has grown significantly, while that of the UK has contracted. [2] Meanwhile, France’s high-value food & drink and leisure & tourism industries, being the home of champagne, the Côte d’Azur, and world-class ski resorts, are expected to have performed strongly in 2022 as international travel and hospitality continued their normalisation post-pandemic.

France was able to cope particularly well in 2022 amidst the energy crisis facing the continent. Inflation came in at 5.9% across the year, peaking at 7.1% in October and November. Though this was considerably elevated compared to historic averages, it was much lower than other European nations. For instance, inflation in Germany reached 9.6% across 2022, peaking at 11.6% in October.

The composition of France’s energy supply was one of the reasons behind its more muted experience with inflation in 2022. A much greater share of the country’s electricity is generated from nuclear power, meaning lesser reliance on imported Russian gas. This helped to reduce France’s experience of the energy price shock last year, despite the country’s nuclear system running below capacity.

In addition, the French government acted early to limit households’ exposure to volatility in wholesale energy markets. A series of means-tested subsidies were provided for households to cover their bills, while electricity price rises were capped at 4.0% year-on-year and gas prices frozen. As a result, the price changes faced by consumers were much smaller in magnitude than those in other countries. Given that energy was the main driver of inflation in Europe in 2022, this helped to keep headline price growth down in France.

The outlook for France in 2023 is somewhat weaker, however. The policy capping energy price rises has changed as of the new year, with energy providers now able to raise prices by up to 15.0%. French consumers will face more expensive bills as a result, in a move that will put upward pressure on the headline rate of inflation. As such, France will likely see more of the consumer-driven headwinds in 2023 that began to plague other economies last year, such as the withdrawal of more discretionary consumer activity amidst falling real living standards. Businesses are also facing difficulty from rising energy prices, which has held back industrial output recently.

Despite the expectation of weaker performance in 2023, the resilience of the French economy in recent years should be commended. A number of other factors could be contributing to this relative success. France consistently performs better than the OECD average on the PISA (Programme for International Student Assessment), signalling an educated workforce and relatively higher level of human capital. Meanwhile, output per hour worked was approximately a quarter higher in France than in the UK in 2019, according to the Penn World Table, signalling high productivity.

Overall, Cebr expects France’s economy to grow by 0.3% across 2023, a marked slowdown on the prior two years. The rate of population growth has also averaged 0.3% per year over the past five years. If this rate were to prevail once more in 2023, this would imply a stagnation in France’s GDP per capita. Nevertheless, performance is still expected to be stronger in France than in similarly sized economies. Output contractions, in both absolute and per capita terms, are currently forecasted for both the UK and Germany, for instance. Though there may well be measurement issues that make comparing GDP across countries difficult, such as Cebr’s much-quoted work on the Flat White Economy and how this holds back the ‘official’ size of the UK economy, it can still be concluded that France’s economy is currently more resilient than many of its neighbours. The factors listed throughout this piece are all likely to be contributing, but they do not necessarily tell the full story. We would invite regular readers to share their expertise on this subject.

[1] The five largest economies being the UK, Germany, France, Spain, and Italy.

[2] Financial service activities, except insurance and pension funding. Most recent data used for international comparison. Sector in France was 11.0% bigger in 2020 than in 2016. Sector in the UK was 18.0% smaller in 2021 than in 2016.

For more information contact:

Sam Miley, Senior Economist – smiley@cebr.com – 020 7324 2874

Cebr is an independent London-based economic consultancy specialising in economic impact assessment, macroeconomic forecasting and thought leadership. For more information on this report, or if you are interested in commissioning research with Cebr, please contact us using our enquiries page.