Yesterday (September 30th) marked the final day of the Government’s Coronavirus Job Retention Scheme. First announced in March 2020 and set to end in May of last year, the furlough scheme had been extended several times in the hopes it would prevent a spike in unemployment that would have otherwise been expected given the sharp economic downturn.

Eighteen months after it started and one day after it ended, we can now give a preliminary answer as to whether the furlough scheme was a success. If we measure the scheme by its effectiveness in preventing a spike in unemployment last year, the answer is a clear yes. Cebr’s May 2020 forecasts expected unemployment to peak at 3.3 million (9.6%). In large part thanks to the extended furlough scheme, the reality proved less dire with a peak of 1.8 million (5.2%).

Latest official statistics[1] show that at the end of July 1.6 million people were still on the scheme. If that number continued to taper off at similar rates to those seen over July, it would leave a bit more than a million people (1.06m) on furlough by the time support was withdrawn entirely at the end of September.

The final answer on whether the scheme was a success rests in part on what happens to those one million people after September. Cebr expects unemployment to increase by 225,000 between Q3 and Q4 2021, suggesting the other 832,000 will find themselves in work or economically inactive e.g. going back to study or entering retirement. Of those going back to work, some will go back to working for the employer that furloughed them, others will find new jobs and some of them have been working all along and either fraudulently claiming furlough or benefiting via a legal loophole.

Focusing on the 225,000 that we expect to end up unemployed, they are most likely to be in the arts, entertainment and recreation industry or one of the lines of work falling under the ‘other service activities’ label which includes membership organisations, beauty services, repairs and cleaning. These are not the industries with the highest number of furloughed staff, but the ones with the greatest mismatch between the number of furloughed staff and vacancies.

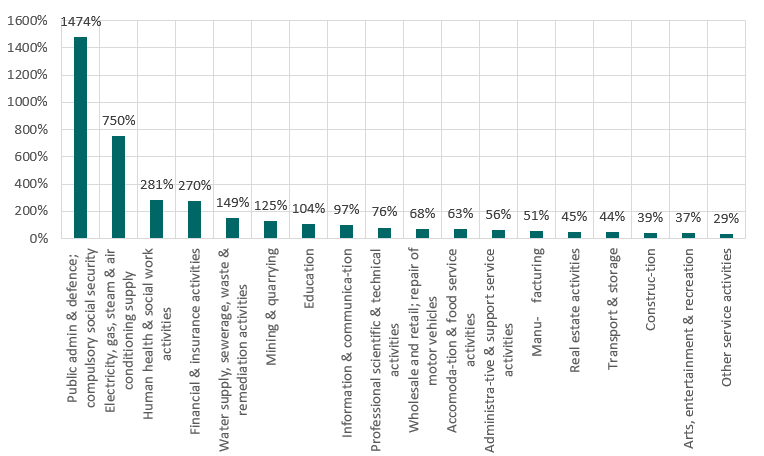

The figure below shows the number of vacancies in a given industry as a share of furloughed staff. While the two are not directly comparable due to other considerations such as location of the vacancy and occupation, this is a useful high-level measure of how easy it will be for those coming off of furlough to find a job within the same sector.

Figure 1: Vacancies as a share of furloughed staff, by industry [2]

What the above numbers tell us is that employment prospects for those coming off of furlough and not going back to their previous employer, vary greatly depending on the industry in question. For every vacancy in the arts, entertainment and recreation industry there are nearly three (2.7) people still on furlough while in the health space there are nearly three vacancies (2.8) for every furloughed worker.

Looking at the labour market overall, Cebr expects the unemployment rate to reach 5.2% in Q4 2021 and gradually return to pre-pandemic levels by Q1 2023. Considering the severity of the GDP contraction last year, these numbers are not overly stark suggesting the furlough scheme largely achieved its goal of preventing rather than just delaying job losses.

One important criticism of the scheme is that it could have achieved just as much for the labour market, even at a much lower cost. The cumulative price tag of the scheme is expected to be in excess of £70bn. When it was first announced in March 2020 it made sense to make the scheme extremely broad so businesses could access support quickly and easily. However, in subsequent extensions there was room to tighten the criteria and make the scheme more targeted towards businesses that a) were genuinely impacted by the pandemic and b) had realistic long term survival prospects. The persistently broad-brush approach has added even more than necessary to the mountain of debt, leaving the UK more vulnerable to a rise in interest rates that could happen sooner rather than later given the current inflationary trajectory.

[1] https://www.gov.uk/government/statistics/coronavirus-job-retention-scheme-statistics-9-september-2021

[2] The analysis uses vacancy data for Aug 2021 and end July 2021 furlough figures.

For more information please contact:

Nina Skero Chief Executive, Cebr

Email: nskero@cebr.com

Mobile: 07930695728