This week saw the announcement of the Government’s plans for long-awaited reform to the social care system, an issue that has plagued Prime Ministers for decades. The reforms, which come into force from October 2023, involve a cap of £86,000 on the care costs paid by individuals across their lifetime, and tapered care cost support for those with financial assets worth less than £100,000. Nearer-term funding was also pledged for the NHS to tackle the Covid-19 backlog.

To fund this £12 billion-per-year care reform and short-term health spending, the government announced a 1.25 percentage point increase in national insurance contributions (NICs) for both employees and employers from April 2022.

These changes, as well as the hike in corporation tax and five-year freeze on income tax bands announced in this year’s Budget, are estimated to bring the value of taxes as a proportion of national income to 35% by 2023/24, the highest tax burden in at least 50 years. [2]

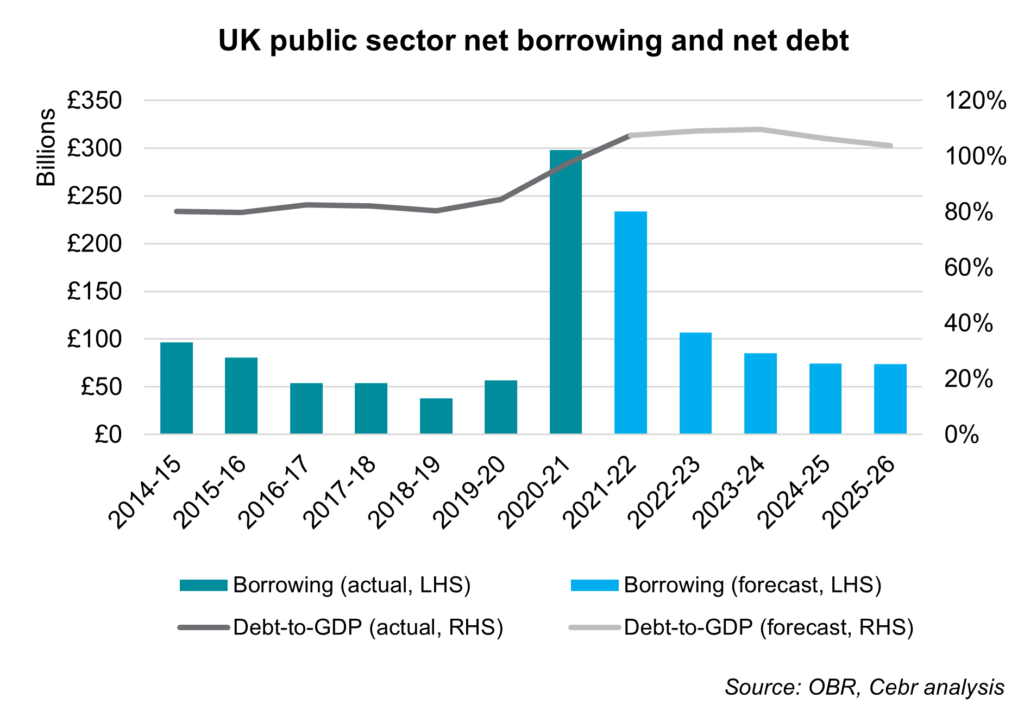

Could the extra £12 billion annual spending have instead been funded through increased government borrowing? Given the relative ease with which the Government borrowed £298 billion in the 2020-21 financial year, the proposed sums are clearly not eye-watering.

Compared with March 2021 Office for Budget Responsibility (OBR) forecasts for the current financial year, year-to-date borrowing as of July was 25.1%, or £26.1 billion, less than expected. As policy has been set with these forecasts in the mind, the Government could already cover at least two years of health and social care funding with the year-to-date ‘savings’. Indeed, assuming that this 25.1% gap continues for the remainder of the year, public sector net borrowing this year could come in £58.6 billion lower than expected at £175.3 billion. This suggests the Government could allocate funds to health and social care for almost five years without affecting national debt forecasts.

Whilst much of the focus in recent days has been on social care, the raised funds will, in reality, be used to tackle the NHS backlog in the nearer term. Commentators have also expressed doubt that funding will be able to be subsequently reallocated away from the NHS, particularly around an election period. As such, the policy is more one-off than it initially seems, weakening the case for taxation as opposed to borrowing, and especially as the economy still recovers.

A key factor considered by the Government in such decisions, beyond ideology, is the expected cost of borrowing in the years ahead. Interest servicing costs for the four months of the current financial year to July were £21.3 billion, up from £13.6 billion over the same period last year. Given the real opportunity costs of such diverted public funds, continually increasing borrowing costs represent a risk that should not be ignored.

Behind the recent rise in the cost of borrowing is not only the increase in the debt stock itself, but also rising inflation, as a large fraction of the Government’s debt is linked to RPI inflation. Index-linked gilts account for £448bn of government debt, or around 24% of the total public debt portfolio, leaving it exposed to price pressures. Annual RPI inflation of 3.4% was seen in Q2 2021, up from 1.2% a year earlier, and Cebr forecasts show this peaking at 4.5% in Q4 2021. However, RPI is set to fall in 2022, reaching a more typical 3.1% in Q2. The anticipated return of RPI inflation to more usual rates next year implies that the current increase in borrowing costs will be more short-lived than is often stated.

Those nervous about excessive public debt are clearly not completely without reason. On top of this, the choice to permanently increase the size of the state to incorporate social care, seemingly supported by the public, will likely require sustainable funding in the longer term. However, opting for significant taxation rather than borrowing in the nearer term, the Government has chosen to slow the UK’s economic recovery. This is despite signs that the recovery is already losing steam, as shown in this week’s disappointing GDP figures for July. Increasing employers’ costs and reducing in households’ disposable income will unnecessarily further hamper growth and employment.

With the termination of the furlough scheme coming at the end of this month, Cebr is currently forecasting that the unemployment rate will rise by 0.8 percentage points to 5.3% in Q4 2021. The hike in national insurance – as well as the changes made in this year’s Budget and the end to the moratorium on commercial rents in March 2022 – will make for a rocky start to the next financial year. Borrowing, at least in the short-term, could have softened this economic blow without a serious risk of ballooning servicing costs.

[2] https://ifs.org.uk/publications/15597

For more information please contact:

Karl Thompson, Economist Email kthompson@cebr.com Switchboard: +44 (0)20 7324 2850