Black Friday discounts may attract some shoppers hoping for a bargain on their Christmas shopping, but are unlikely to save struggling retailers from the rising number of insolvencies in the sector. The cost-of-living crisis, combined with warnings that discounts are often more generous at other times of year and the threat of a Royal Mail strike, will mean that it is a weak year for Black Friday sales and we may see January sales start early in an attempt to shift stock. [1] Furthermore, Cebr research[2] shows that Black Friday’s main effect is to shift spending that would otherwise have happened in the weeks surrounding the discounting period, rather than increasing spending overall.

Black Friday was brought over to the UK by US retailers in the early 2010s as a way to kickstart Christmas retail spending. Its popularity has increased ever since, to become an established part of the UK retail sales calendar. Though, rather than boosting overall spending, the discounts tend to shift it. This is corroborated by official retail sales data from the Office for National Statistics. The combined value of November and December retail sales, excluding automotive fuel, increased by 42% between 2011 and 2021, which is roughly in line with the 39% increase in retail sales values for the other ten months of the year.[3] Retail sales volumes reveal the same trend, with November and December sales standing 31% higher in 2021 than 2011, and sales for the rest of the year rising by a cumulative 30%.

For this year’s Black Friday, we expect the same trend of sales rising in the last week of November, though the cost-of-living crisis looks set to have an impact. While 42% of Brits have reported shopping around more due to the rising cost of living, suggesting they are looking for discounts, a higher share, 65%, reported they are spending less on non-essentials due to these cost pressures.[4] Though very high, this latter share is unsurprising given the current economic environment. Indeed, Cebr’s Asda income tracker which monitors changes in discretionary incomes, that is, the amount of income left over after tax and essential spending, shows that households had £36 a week less to spend on non-essentials in October than a year ago on average. Those with the lowest incomes even have negative discretionary incomes.

This year in particular, shops have built up high levels of inventories to deal with the supply chain issues that have been present since the pandemic. In the first half of 2022, retail inventories rose by over £6.3 billion, compared to a £1.6 billion rise in the first half of 2021.[5] If these stocks are not shifted, then discounts may get more generous the closer we get to Christmas, disincentivising Black Friday purchases. Indeed, we may see some January sales start early in attempt to use up inventories.

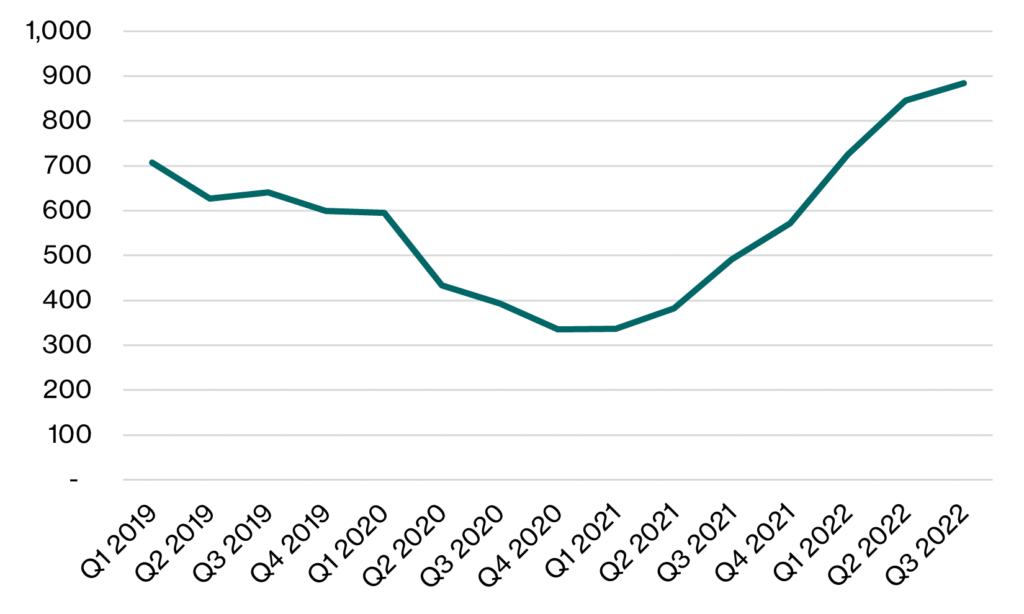

Many retailers are already going out of business amid the difficult trading environment. Wholesale and retail sector insolvencies were 38% higher in Q3 2022 than the same quarter in 2019, according to data from the Insolvency Service. Meanwhile, Cebr is forecasting real household consumption expenditure to fall by 0.6% in Q4 2022, and also contract in Q1 and Q2 2023. On an annual basis, real consumption in Q4 is projected to be down by £1.5 billion. This reduced consumer activity poses a risk of further insolvencies in the retail sector, highlighting the impact of the cost-of-living crisis on businesses.

Wholesale and retail trade sector insolvencies

Source: Insolvency Service

[1] https://www.bbc.co.uk/news/business-63720309

[2] https://cebr.com/reports/retailers-hoping-to-see-final-quarter-revenue-boost-from-black-friday-will-be-disappointed/

[3] Seasonally adjusted, current price retail sales value data from the Office for National Statistics (ONS)

[4] ONS public opinions and social trends survey, 26 October to 6 November 2022

[5] https://www.ons.gov.uk/economy/grossdomesticproductgdp/timeseries/fbyn/ukea

For more information please contact:

Josie Dent, Managing Economist Email jdent@cebr.com Phone 0207 324 2864

Cebr is an independent London-based economic consultancy specialising in economic impact assessment, macroeconomic forecasting and thought leadership. For more information on this report, or if you are interested in commissioning research with Cebr, please contact us using our enquiries page.